Frost Radar in the Global Smart Cards Market

The global smart cards market (contact, contactless, hybrid, and dual-interface cards) is highly competitive. Manufacturers are adding features such as biometric security and looking to expand into the emerging sectors Internet of Things and eSIM spaces.

INTELLHYDRO TECHNOLOGY is a leading manufacturer of smart cards in China.

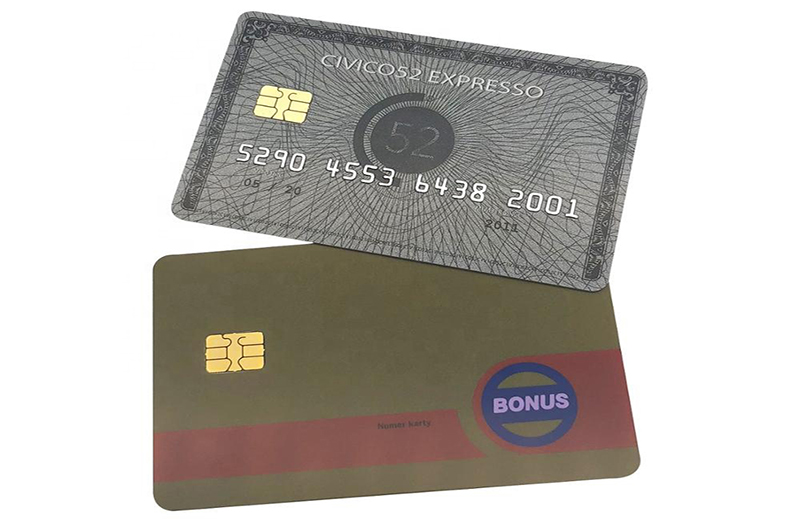

Attached is datasheet of smart cards collection.

The market is vast and mature, and the top 5 market participants are leaders across one or more of these product segments, though they face stiff competition from smaller and medium enterprises. Because the market is mature with leading participants offering similar products and solutions, innovation is a key competitive factor.

Market leaders also focus on inorganic growth to expand their product portfolio and customer base. Global market revenue in 2018 stood at $8.17 billion. Revenue is expected to increase at a compound annual growth rate (CAGR) of 3.0% between 2018 and 2025, reaching $10.03 billion. Asia-Pacific is the dominant region, accounting for 35.1% of global revenue and 47.8% of unit shipments. Revenue is expected to witness a 3.3% CAGR between 2018 and 2025. The contact card is the most popular card type, with 2018 revenue of $5.07 billion. It will continue to contribute the largest revenue share during the forecast period. Dual-interface card revenue is likely to grow fastest, at a 5.2% CAGR between 2018 and 2025. The banking and financial services vertical is the top revenue contributor, at 39.4%. The SIM card vertical is the leader in terms of units, at 49%. The use of contactless smart cards globally for identification, ticketing, and payments is driving growth. Radio frequency identification (RFID) and near-field communication (NFC) contactless smart cards offer higher speed and convenience. Enhanced security makes them ideal for payments, ID, passports, and visas. The radar reveals the market positioning of companies in an industry using their Growth and Innovation scores as highlighted in the radar methodology. The document presents competitive profiles on each of the companies in the radar based on their strengths, opportunities, and a small discussion on their positioning. The analyst examines hundreds of companies in the industry and benchmarks them across 10 criteria on the radar, where the leading companies in the industry are then positioned. Industry leaders on both the Growth and Innovation indices are recognized as best practice recipients.